how to calculate cost of stock

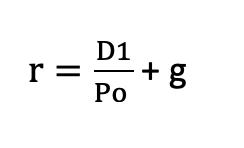

The formula used to calculate the cost of preferred stock with growth is as follows. The cost basis of stock you received as a gift gifted stock is determined by the givers original cost basis and the fair market value FMV of the stock at the time you received.

Cost Of Common Stock Formula Accountinguide

There are just a few simple steps to figure out this price.

. Rp 400 1 20 5000 20 The formula above tells us that the cost of preferred stock is equal. Stock profit current stock price - cost basis n. Then Stock profit 100 USD - 7992.

Cost basisis the original purchase price of an asset. In the spreadsheet program of your choice or by hand if that suits your fancy make columns for the purchase. Sign in to your brokerage account.

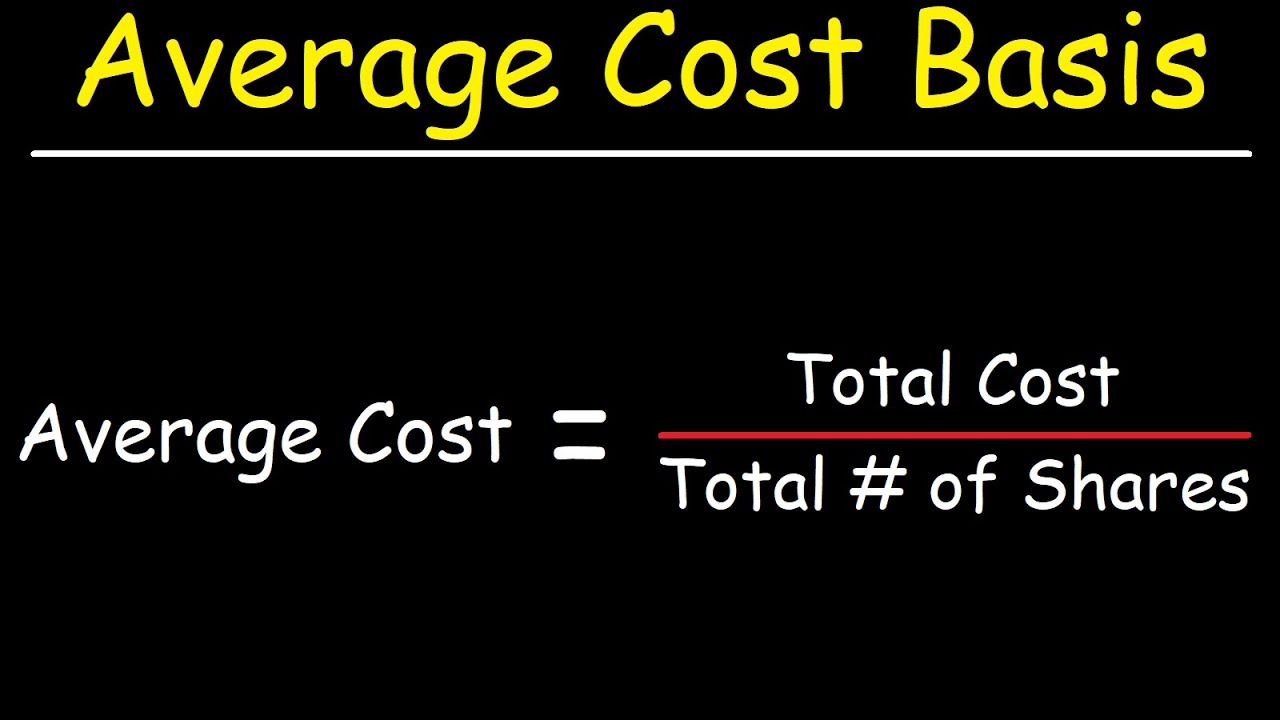

Your gain or loss is the net proceeds how much you sold the shares. The average adjusted cost basis per share is 25 5000. The cost basis is the average cost per share that you paid times the number of shares that you sold.

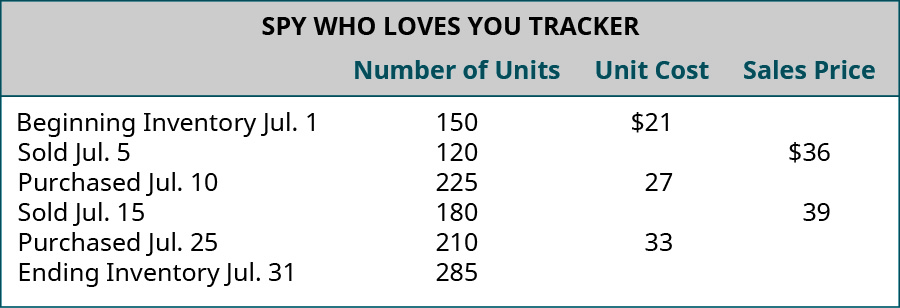

Calculate the after-tax cost of preferred stock for Marvell Corporation which is planning to sell 580 million of 6 cumulative preferred stock to the public at a price of 40 per share. In this example multiply 100 by 10 to get 1000 multiply 200 by 7 to get 1400 and multiply 250. FIFO first in first out LIFO last in first out and average cost.

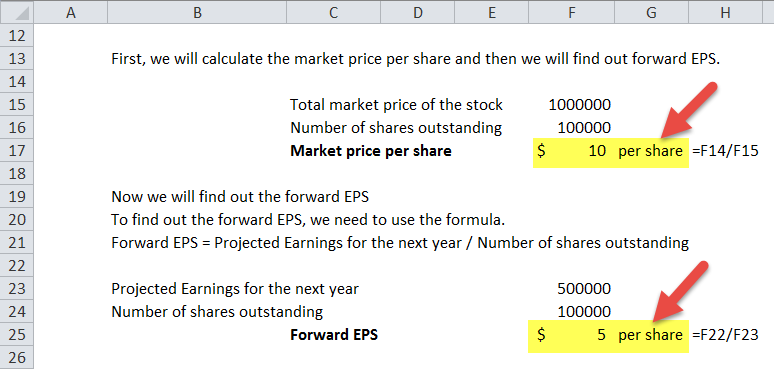

Heres the formula. Now from this data we have to calculate common stock by using the formula. Youll need to find the record of the purchase date and price of the stock you hold.

150 x 5 - 100 x 5 250. When you buy stocks mutual funds or other securities your cost basis is the price you pay for it on the day that you purchase. Businesses can use one of three main methods for calculating inventory costs.

Dividend Discount Model Dividend Discount Model uses the common stock dividend as the basis to evaluate the rate. Multiply the number of shares in each transaction by its purchase price. 41 x 50 2050.

Its always recommended for you to try these first. Lets say that AMD stock rose to 100 USD per share today. For example if you buy 100 shares at 20 and later buy another 100 shares at 30 your total cost basis is 5000 100 20 100 30.

Common stock Total EquityTreasury stock-Additional paid-incapital-preferred. To calculate your profits for tax purposes youll need to subtract your cost basis for the five shares from the sale price of the five shares. There are three methods to access the cost of common stock.

The FIFO method assumes the.

How To Calculate Food Cost Percentage With Examples Lightspeed

Cost Of Goods Sold Cogs Formula And Calculator

How To Calculate Your Average Cost Basis When Investing In Stocks Youtube

Forward Pe How To Calculate Forward Price Earnings Ratio

How To Calculate Cost Of Common Stock Equity Accounting Hub

How To Calculate Cost Of Common Stock Equity Accounting Hub

![]()

Cost Of Goods Sold Definition Examples Cogs Formula

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

Common Stock Formula Calculator Examples With Excel Template

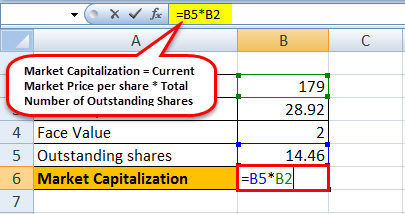

Market Capitalization Formula How To Calculate Market Cap

Using The Data For A Firm Shown In The Following Table Calculate The Cost Of Retained Earnings And The Cost Of New Common Stock Using The Cost Of Retained Earnings Versus Valuation

Cost Of Preferred Stock For Startups Plan Projections

Cost Of Preferred Stock Calculator Calculator Academy

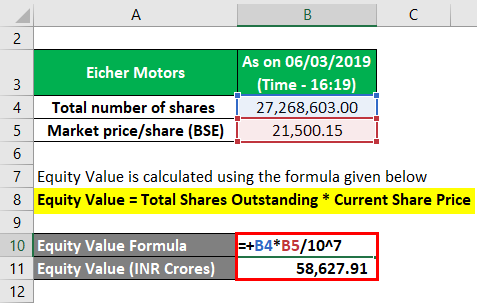

Equity Value Formula Calculator Excel Template

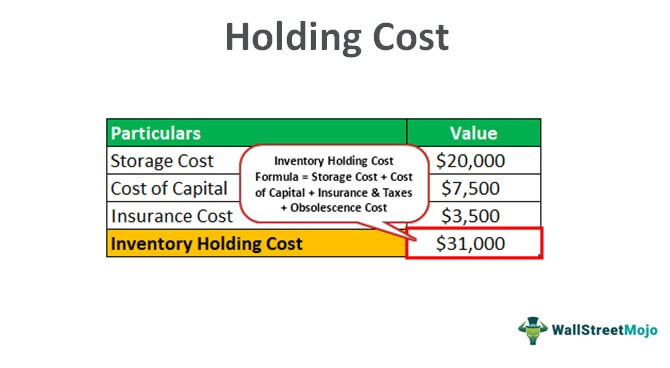

Holding Cost Of Inventory Definition Formula Calculations

6 Best Safety Stock Formulas On Excel Abcsupplychain

2 7 Inventory Cost Flow Methods Periodic System Financial And Managerial Accounting

Step By Step Tutorial For Calculating Weighted Average Cost Of Capital Wacc Stockbros Research